Balancing the benefits and drawbacks of automation

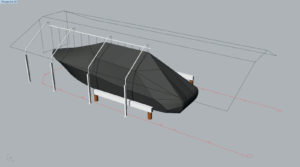

Chris Ritsema, owner of Canvas Innovations in Holland, Mich., says the company relies heavily on its Carlson Design Plotter/Cutter. “Everything we manufacture is patterned, digitized with photogrammetry, plotted and cut on our Carlson table.” Photo: Canvas Innovations.

It’s always important to measure the return on investment (ROI) of any purchase—especially in the areas of equipment. The challenge is to balance the capabilities (and availability) of equipment and employees as automation and technology drive the future of the industry.

Canvas Innovations in Holland, Mich., focuses on custom marine canvas and upholstery products, says owner Chris Ritsema. The company also has a smaller portion of the business dedicated to other textile-related products, such as porch enclosures, shade sails, awning recovery, furniture covers, golf cart enclosures and a wealth of other custom projects.

“We continue to measure the market and stay open to other products that will keep us diversified,” Ritsema says.

With this breadth of market coverage, Ritsema and his team rely on Juki sewing machines set up with pneumatic back tacks and auto thread trimmers. The machines are computerized, so they have the capability to be programmed for custom production runs as well.

“We believe in the benefit of having current equipment, as this allows us to stay ahead and keep efficient,” Ritsema says. In January 2017 he purchased an automated cutting table. “It has increased our efficiency and has given us the benefit to keep repeatable CAD files for all our custom work. Our current table provides us 32 feet by 8 feet of cutting surface,” Ritsema says.

Canvas Innovations is currently beta testing a new 3-D measuring tool, which will save on time and materials as the company creates 3-D renderings on location. “We work with Rhino and ExactFlat software to prepare our data for our cut files,” Ritsema says. “This is our newest tool we are still in the process of testing.”

Marco Canvas uses the Proliner® from Prodim Intl. to create digital patterns and raw pattern models.

Know-how, present and future

When Ritsema purchases equipment, he doesn’t have a specific ROI deadline firmly in place; he generally likes to pay equipment off in 12 to 18 months.

“Technology changes so fast it doesn’t make sense to pay out on equipment more than two years if it isn’t generating revenue,” Ritsema says. “I’m not big on debt, so we try to run lean.”

The Canvas Innovations team also keeps up with current software and newer tools as the need arises and as new opportunities come into play. “We are an organization that does our best to keep up with all the current trends and equipment,” Ritsema says. “Automation is pretty much limited to cutting and plotting at this point in time for us.”

Ed Skrzynski, owner of Marco Canvas & Upholstery LLC, says that along with traditional sewing machines with Servos and needle positioning, radio frequency welding and automated grommet setting, his company has a full array of digital automation tools.

For some projects, Marco Canvas

uses both the Leica Disto Laser and the Proliner. Shown here, Marco Canvas used the Disto Laser to scan the boathouse where the boat was to reside, and the Proliner was used to pattern the boat. Photos: Marco Canvas & Upholstery LLC.

From photogrammetry, which converts 2-D plastic/paper patterns into digital format; to the Prodim Proliner, a point-to-point measuring system; to digital automation cutters and plotters, Marco Canvas embraces automation throughout all aspects of the company. “A laser scanner will be a planned capital purchase this year, as we know the cost-down for patterns and cutting will be around an 80 percent savings for upholstery recovers,” Skrzynski says.

After much research, Marco Canvas purchased its first automatic cutter and plotter in 2011. “Price played a key role in the selection of this machine, but I also loved the simple step motor design without all the bells and whistles that would not be used much,” Skrzynski says. “What used to take me 45 minutes, to mark and cut hospitality bin liners and covers, now takes only 4.5 minutes, and I dropped from 11 yards down to 10 yards. So cutting and plotting was 10 percent of what it was, and material use was cut down by 9 percent.”

While purchasing and updating equipment on a continuous basis—as well as determining the ROI—can be challenging, finding and training people to actually run that equipment is even more daunting.

“Skilled labor that has the work ethic and passion for what we do is a hard find,” Ritsema says. “This is a very unique trade skill and it’s hard to find someone that will stay for the long haul. Generally speaking, in this industry, the owners stay for the long haul—and then shut their doors.”

So does having high-end equipment entice the younger set to seek employment within the specialty fabrics industry?

“We are seeking younger workers for CAD design and pattern-making,” Ritsema says. “It is more attractive when technology comes into play.”

Miller Weldmaster’s T300 Extreme is a popular piece of equipment in the marine industry. Available for both hot air and hot wedge welding, it handles a wide variety of materials and welds including hems, overlaps, hems with pockets, hems with rope and more. Photo: Miller Weldmaster Corp.

Automating solutions

When it comes to automation, equipment suppliers also work hard to ensure that fabricators are using the most applicable equipment for their needs. As Jeff Sponseller, chief marketing officer at Miller Weldmaster® explains, the company and its employees like to think of themselves as problem-solvers.

“Many of our customers make several different product lines. As such, we have to ensure that our automation solutions are versatile enough to meet our customers’ product lines,” Sponseller says. “While many assume that reducing labor is the most important part of automation, oftentimes we find our customers are seeking a better quality product.”

As an Ohio-based company that sells fabric-welding machines for the specialty fabrics market, Miller Weldmaster supplies a complete line of machines to encompass markets ranging from awnings, shade and marine to medical, military and safety and protective products. The company also offers a complete custom and automation department.

“Every machine that we sell comes with a full training package to ensure that not only does the customer know how to use their new machine, but they also are efficient,” Sponseller says. “We believe good installation and training is vital to a successful product launch at any size company.”

According to Sponseller, the company has customers who have never owned a Miller Weldmaster—and their first purchase is a complete automation system. “However, many of our customers are longtime Miller Weldmaster customers who want to increase their production. Sometimes they start out by buying multiple machines and slowly realize that automation solutions are a better fit for their production demands,” Sponseller says.

In his experience, the biggest workforce concern is companies’ inability to attract and maintain sewers and seamstresses. “It seems that this generation has lost that skill set due to lack of need. However, our industry still requires it,” Sponseller says. “We have had customers tell us that because of their inability to have enough seamstresses they need to consider automating their process.”

In addition to custom marine canvas, Canvas Innovations in Holland, Mich., manufactures shade awnings that cover vacuum stations at car washes throughout the U.S. Shown here is a production run using its Carlson Design Plotter/Cutter. Photo: Canvas Innovations.

Equipment and employee

Skrzynski points out that every trade has trouble finding and keeping skilled labor. “We offer internships and apprentice programs to help train our workforce,” he says. “Thirteen of our staff grew from this model.”

At Marco Canvas, Skrzynski also finds that training employees on more advanced, automated equipment is actually easier, especially when you have created standard operating procedures.

“Trying to teach software to older candidates is more difficult,” he says. “Software like 3-D CAD can take a year to learn and years to master. Younger people tend to have been around PCs their entire life, and things just seem to click for them. However, even young ones that have never touched 3-D CAD will take significantly longer to train, so we tend to look for a bit of experience in CAD to shorten the learning curve.”

In some rural locations, the lack of a skilled workforce has helped drive automation. For example, Thomas Carlson, manager of Carlson Design in Tulsa, Okla., the originator of the large-bed plotter/cutter, talks about working recently with customers in Ireland.

The Irish company had hired five people over the last year to keep up with cutting demand.

“They finally decided throwing unskilled labor at the problem wasn’t the answer, and decided it was time to automate,” Carlson says. “Other customers have reported adding technology as being a big draw to retaining and attracting the next generation of employees. They have mentioned how it allows their existing workforce to work past their typical retirement age because the plotter/cutter reduces the job’s physical demand.”

Over the last 31 years, Carlson Design has helped automate operations in more than 50 different industries in more than 45 countries. A lot of this growth is driven by the general acceptance and understanding of computers, access to affordable or even free CAD software, and the company’s continuing efforts to simplify the processes involved in automation.

And while automation is becoming more imperative across the specialty fabrics industry, Carlson says customers value a complete solution first and price second. Price is still very important, but automated equipment needs to address company needs first.

“Our customers are very self-sufficient, and they appreciate how we let them provide some of their own components to save on cost,” Carlson says. “If a new customer would like to build their own table or use a new computer they just bought, we love to help them help themselves. That allows them to satisfy both objectives of getting a complete system, at a great price.”

Paradigm shift

Frank Henderson, CEO of Henderson Sewing Machine Co. Inc. in Andalusia, Ala., says reductions in the cost of automation technology have created a paradigm shift as systems and robotics have become more affordable for small-to mid-size manufacturers, allowing them to take advantage of smart, collaborative, flexible and easy-to-use robotics and automated systems.

“The ability for manufacturers to utilize today’s affordable robotics and automation technology to fill skills gaps shortages and ensure accurate, consistent repeatability and quality will enable manufacturers in America to compete,” Henderson says.

Simply put, Chris Ritsema says that in the next five years technology will be the norm, and those who don’t embrace it will be phased out or will struggle to survive.

“Custom products will still be done using technology but will be manufactured at a faster pace and will offer seamless repeats to the client,” he adds.

Ed Skrzynski says there is demand to go digital for custom work, and where you have demand you will find suppliers to unlock the digital process in custom, one-off textiles products. “It has proven to be a good path for us, as we have significant growth both in sales and in profit margins. With automation we are much faster and have a wider product diversity that keeps us growing.”

High-volume repetitive work technology will claim many jobs, says Skrzynski, but this has been happening since the Industrial Revolution.

“You can choose to look at technology as a job killer or a job preserver,” he says. “Being globally competitive to stay in business is what drives automation innovations and implementation for us.

I certainly see it as ‘the one with the most patterns and with the best efficiency will survive and thrive.’ That, and the need to continuously reinvent your company into the next textile industry.”

Maura Keller is a freelance writer based in Plymouth, Minn.

TEXTILES.ORG

TEXTILES.ORG