2023 State of the industry

The Advanced Textiles Association’s annual State of the Industry survey shows that inflation, the supply chain and hiring remain top concerns, but revenues are up and growth plans are in the works for most respondents.

Nearly 160 firms took the survey, with two-thirds having fewer than 50 employees. Most respondents were from end product manufacturers (36%), suppliers (14%) and marine fabricators (13%).

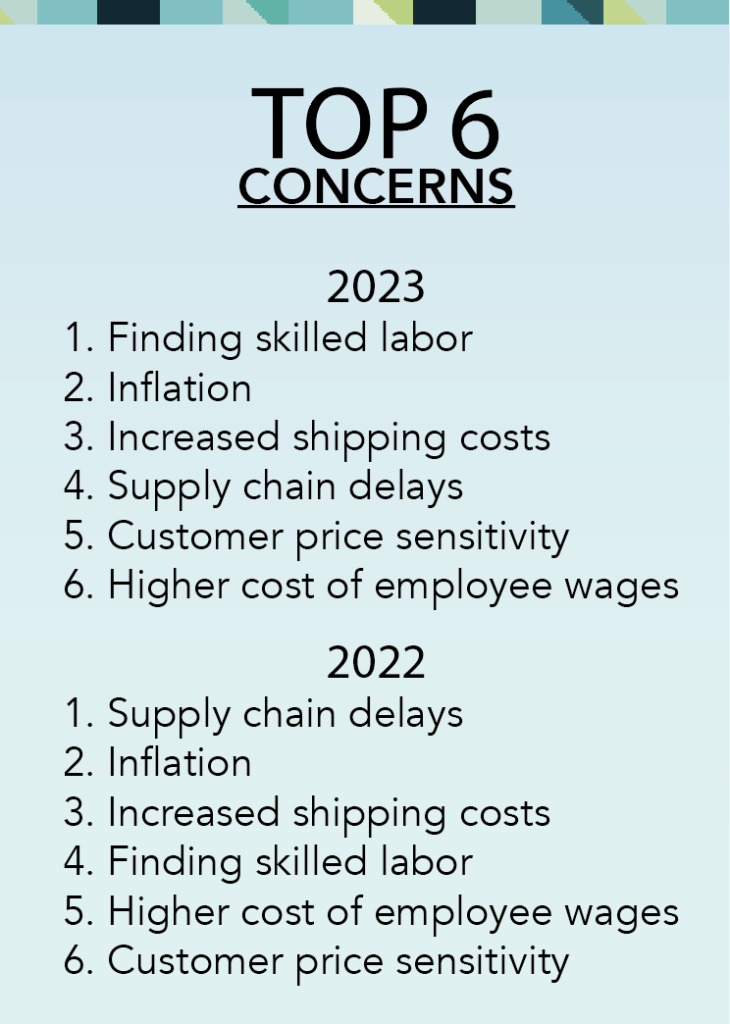

Overall, the 2023 responses were similar to last year’s: revenues and prices are up, and many companies plan to expand into new markets. Compared to 2021, revenues were up in 2022 for 65% of respondents, and 70% reported revenues above pre-COVID figures. As with last year, the top concerns relate to costs, price sensitivity, labor and supply chain delays.

Inflation and recession worries

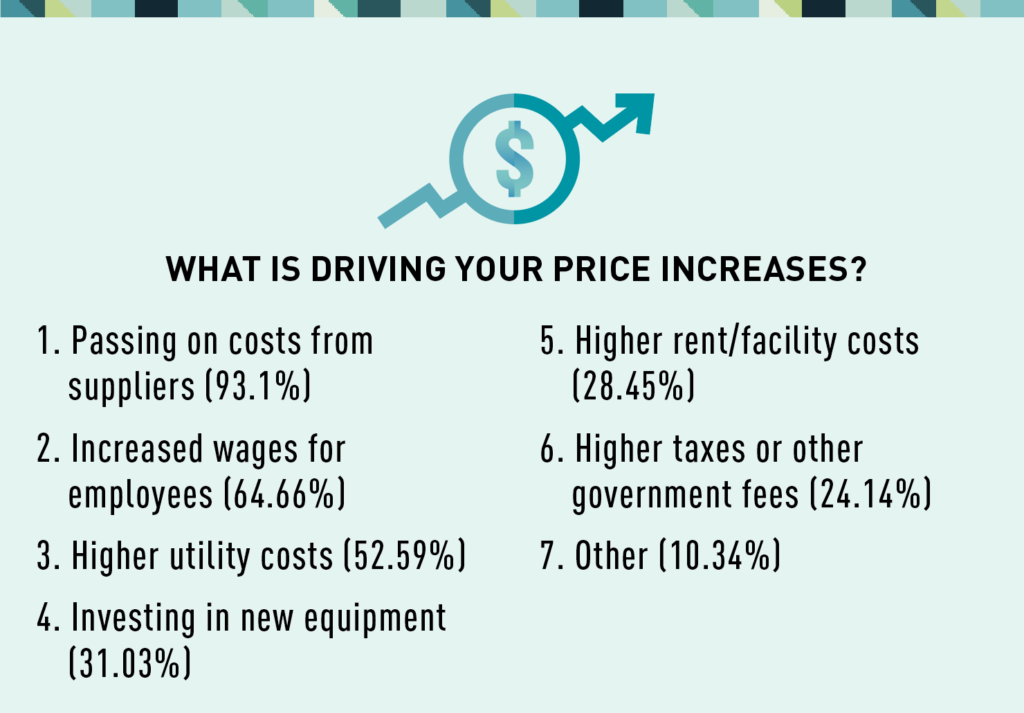

Last year, people were somewhat concerned about how the war in Ukraine would affect business. This year it’s the possible recession. Companies are paying more to employees and suppliers, and they are spending more on utilities and are passing at least some of those increases on to customers by raising their prices again (94%, with 58% having to raise prices by at least 10%), which may be why customer price sensitivity has reached this year’s top six concerns.

However, despite recession fears, 63% of respondents expected revenues to rise in 2023, with almost a third projecting them to be up by more than 10%.

Growth despite labor challenges

Almost half of respondents are working on new product lines with their existing capabilities (49%) and entering new markets (47%). The most important strategic areas for companies in the next two years include product diversification, improvements to supply chain/logistics and employee development programs.

While some companies reported having difficulty finding people interested in taking up the trade, nearly 83% reported their staffing levels as up or unchanged from last year. Despite this, “finding skilled labor” moved to the top of the list of concerns.

Despite these challenges, 34% plan to buy new equipment and nearly 23% are exploring some kind of automation.

TEXTILES.ORG

TEXTILES.ORG